LPA Asia Smart News

Raphaël Chantelot

Nicolas VanderchmittPartnerHong Kong

Nicolas VanderchmittPartnerHong KongNicolas Vanderchmitt

Camilla VenanziAssociateHong Kong

Camilla VenanziAssociateHong KongCamilla Venanzi

Jean-Yves ToullecPartnerHong Kong

Jean-Yves ToullecPartnerHong KongJean-Yves Toullec

Yun ZhangAssociateShanghai

Yun ZhangAssociateShanghaiYun Zhang

Arnaud Bourrut-LacouturePartnerSingapore

Arnaud Bourrut-LacouturePartnerSingaporeArnaud Bourrut-Lacouture

Hélène LiuAssociateShanghai

Hélène LiuAssociateShanghaiHélène Liu

Irène Bernard-EspinaAssociateSingapore

Irène Bernard-EspinaAssociateSingaporeIrène Bernard-Espina

Astrid CippeOf counselSingapore

Astrid CippeOf counselSingaporeAstrid Cippe

Kosuke OiePartnerTokyo

Kosuke OiePartnerTokyoKosuke Oie

Ayano KanezukaPartnerTokyo

Ayano KanezukaPartnerTokyoAyano Kanezuka

Karim BoursaliAssociateSingapore

Karim BoursaliAssociateSingaporeKarim Boursali

Airi TozakiCounselParis

Airi TozakiCounselParisAiri Tozaki

Ran HuPartnerParis

Ran HuPartnerParisRan Hu

Henrick EmeriauPartnerShanghai

Henrick EmeriauPartnerShanghaiHenrick Emeriau

Mina IshikawaAssociateTokyo

Mina IshikawaAssociateTokyoMina Ishikawa

Sabrine Cazorla ReverreOf counselSingapore

Sabrine Cazorla ReverreOf counselSingaporeSabrine Cazorla Reverre

Li Ke ChengAssociateSingapore

Li Ke ChengAssociateSingaporeLi Ke Cheng

Jean MédecinOf counselTokyo

Jean MédecinOf counselTokyoJean Médecin

Hubert BazinPartnerShanghai

Hubert BazinPartnerShanghaiHubert Bazin

Lionel VincentPartnerTokyo

Lionel VincentPartnerTokyoLionel Vincent

Chin Hiang WuOf counselSingapore

Chin Hiang WuOf counselSingaporeChin Hiang Wu

Fanny NguyenPartnerShanghai

Fanny NguyenPartnerShanghaiFanny Nguyen

Bérengère RoigPartnerSingapore

Bérengère RoigPartnerSingaporeBérengère Roig

Estelle ChenAssociateShanghai

Estelle ChenAssociateShanghaiEstelle Chen

Marie-Gabrielle du BourblancCounselHong Kong

Marie-Gabrielle du BourblancCounselHong KongMarie-Gabrielle du Bourblanc

Pascal MagesPartnerTokyo

Pascal MagesPartnerTokyoPascal Mages

Through this newsletter, we offer you a regular selection of legislative and judicial decision insights prepared by LPA lawyers from its 4 Asian offices as well as some recent news from our teams.

SMART ALERT

Outline of the renewable energy law and regulation and outlook for 2023 in Japan

Hong Kong

Hong Kong lures family offices with tax incentiv

Hong Kong court clarifies that cryptocurrencies are property which can be held on trust

China

France takes the lead as the key jurisdiction for foreign investments in Europe

Highlights on amendments of the counterespionage law and compliance measures

Singapore

Proposed changes to companies act on digital meetings and minority protection

Upcoming changes to Employment Pass eligibility requirements in 2023

Japan

What are the HR obligations applicable to your company ?

What are the new restrictions applicable to consumer agreements?

SMART ALERT

Outline of the renewable energy law and regulation and outlook for 2023 in Japan

Japanese energy policy was traditionally focused on nuclear power as a means of reducing carbon emissions and increasing domestic energy production. However, the Fukushima Daiichi nuclear accident in March 2011 led in aftermath of the accident to a general shutdown of nuclear reactors and the energy shortfall was completed with natural gas and coal.

Conscious that the energy sector is a critical area and aware of the necessity to have rapid development of renewable generation energy, Japan has implemented in 2011, the Act on Special Measures for the Promotion of the Use of Renewable Electricity (Act No. 108 of 2011, the “Renewable Energy Business Act”) which has introduced in July 2012 the Feed-In-Tarif (the “FIT”) system through which renewable energy power producers are entitled to sell electricity to electricity utilities at a fixed price for a fixed term. Under the Renewable Energy Business Act, the definition of “renewable energy” includes solar power, wind power, hydraulic power, geothermal power, biomass, and any other resources other than crude oil, petroleum gas, combustible natural gas, coal, and products manufactured therefrom, which may be designated by a cabinet order in the future.

In 2017, Japan ratified the Paris Agreement which targets to reduce carbon emissions in comparison with 2013 by 26.3% by 2030, and by 80% by 2050. In October 2020, the Japanese government announced plans for the country to become carbon neutral by 2050 and also announced in April 2021 a new ambitious target to reduce carbon emissions by 46% by 2030 in comparison with 2013.

In June 2020, the Act to Amend the Renewable Energy Business Act has been adopted which provides various amendments to energy-related law. It entered into force on 1 April 2022 (the “Renewable Energy Promotion Act”) by introducing, among other things, the Feed-In-Premium (the “FIP”) system by which the energy power purchase price of a utility is determined based on the market price by adding a certain premium.

Since the introduction of the FIT and FIP system, solar photovoltaic projects have developed significantly and offshore winds present now an enormous opportunity since Japan has the seventh longest coastline in the world which could give Japan the opportunity to lead the market for floating offshore wind energy.

The year 2023 is expected to be a year in which new projects will flourish and the new reform of the Renewable Energy Promotion Act will enter into force on 1 April. In addition, the Tokyo Metropolitan Government plans to enforce a new system from April 2025 requiring home builders and developers to install solar PV panels on new buildings and houses, which will lead the renewable energy market to a new phase of development and innovation.

In this first Smart Alert Japan of the year 2023, we present some of the important and recent developments in the offshore wind and solar power renewable energy sector, the outlook on the renewable energy plans of the Tokyo Metropolitan Government, and the upcoming reform in the energy regulations in Japan.

1. The offshore wind and solar power renewable energy in Japan

1.1. The offshore wind renewable energy

Considering the potentialities of large-scale implementation, lowering the costs of electricity, and of having a major impact on the country’s energy strategy and economy, Japan considers offshore wind renewable energy as a key for developing renewable energy as the main power source in Japan.

The development of offshore wind renewable energy presents both an opportunity and a challenge for Japan. Indeed, with a large population and a mountainous and seismic landscape, onshore wind renewable energy projects (and also solar power renewable energy projects) are limited by the few lands available. Such geographical and demographic conditions limit also space for grid connection, and in turn, implied high costs. Therefore, offshore wind renewable energy is a relevant solution to these limitations given that Japan has a long coastline, and the water depths increase quickly near the shore. However, offshore wind renewable energy depends currently on foreign industries for the equipment of the offshore plants. The future challenge for the development of offshore wind renewable energy is to consider reducing costs as well as enhancing competitiveness thereof.

In its 6th Strategic Energy Plan of October 2021, the Japanese government recall the need to develop domestic offshore wind renewable energy given the natural conditions constraints unique to Japan, such as limited flat land.

On 30 November 2018, the Japanese parliament approved the Act for the Promotion of Use of Marine Areas for Development of Marine Renewable Energy Generation Facilities (Act n°89 of 2018) to introduce a new national framework for offshore wind projects in Japan. This law bore the purpose to create a much-needed national framework to coordinate efforts to establish an offshore wind industry in Japan in deep water by designating the promotion areas of offshore wind development and installing a competitive auction process for the rights to develop and build projects in these areas. The method of evaluation for applications to the auction process and other details was to be set forth in public tender guidelines published by the government pursuant to which each bidding would be conducted.

In 2021, the Ministry of Economy, Trade, and Industry (“METI”), announced Round 1 of the auction for offshore wind auctions under the FIT scheme by designating 3 promotions areas ((i) off the coast of Noshiro City, Mikane Town, and Oga City, Akita Prefecture, (ii) off the coast of Oki City, Yurihonjo-shi, Akita and (iii) off the coast of Choshi City, Chiba Prefecture) taking into account the climate and natural aspects of the area, the sea traffic routes, the fishery activity, the likelihood to establish a grid connection to facilities and the transportation of resources to maintain the facility.

Round 2 of the auction process began on 28 December 2022 and is projected to provide at least 1.8 GW of offshore power generation under the first FIP scheme. This round covers 4 promotions areas: (1) Happo Town and Noshiro City (Akita Prefecture), (2) Enoshima, Saikai City (Nagasaki Prefecture), (3) Oga City, Katagami City and Akita City (Akita Prefecture), and (4) Murakami City and Tainai City (Niigata Prefecture). Proposals to the tender process are due by 30 June 2023 with the result expected in March 2024.

1.2. The solar power renewable energy

After the Fukushima Daiichi nuclear accident and the introduction of the attractive FIT system, the number of PV solar power plant projects has considerably increased and solar power accounted for a large part of Japan’s total renewable capacity, occupying the second position following hydropower.

However, due to the substantial decline in FIT prices year after year, investment in such projects is slowing down. Indeed, the FIT amounted to JPY 40 per kilowatt-hour (kWh) at the beginning of the FIT system in 2012, was higher than the global average. However, power companies struggled to meet the important demand for grid connections of PV solar power companies and have started to block the grid connexion. In addition, with the introduction of the FIT scheme, a portion of the purchase price by the power companies was collected from electricity users in the form of a levy in order to facilitate the introduction of renewable energy in the Japanese energy market which remains costly.

In light of this situation, to balance the maximum introduction of renewable energy with the reduction of the public burden, from 2017 onwards, METI has adopted a bidding system for new certification for PV solar power plants with an output ranging from 50 kW to 1,000 kW in the FIT target category. In addition, the government has decided to decrease the FIT prices over the years to slow down the rapid development of renewable energy projects and in particular for PV solar power projects. Japan’s FITs are much lower today, with the solar project ranging from 10kW to 50kW being eligible for JPY 11/kWh and projects ranging from 50kW to 250kW being eligible for JPY 10/kWh for the 2022–2023 financial year. However, residential PV solar power projects under 10kW remain eligible for a FIT of JPY 17/kWh.

The gradual transition from the FIT scheme to the FIP scheme illustrates also the will of the Japanese government to limit the rush by the PV solar power companies. Since 2022, the FIP scheme applies to all PV solar power plants with an output of 1MW or more. In addition, a tender process has become applicable to PV solar power projects with an output between 250kW and 1MW for the FIT system, as well as with an ouptput of 1MW or higher for the FIP system. The tender process is held by the government generally once or twice per year and the government decides on the maximum capacity to be certified and the maximum purchase price. The applicant who is able to propose the lowest purchase price is selected until the total generation capacity of the selected applicants reaches the maximum capacity of the tender process. The conditions of the upcoming tender are published by the tender process public organization, the Organization for Cross-regional Coordination of Transmission Operators.

Japanese PV solar power industry is also facing a lack of domestic manufacturing of solar technology and equipment, in particular in the field of silicon, a natural semiconductor and key component of solar modules, which implies important costs in the construction of the PV solar power plant. Thus, the next challenge for Japan in the coming years will be to develop its domestic semiconductor industry, a challenge that the Japanese government has begun to address by investing heavily and by providing large subsidies for joint ventures with companies from Taiwan, a crucial semiconductor supplier, and the U.S.

Despite this constatation, the outlook on solar power in Japan remains positive. In 2020, Japan has achieved an installed capacity of 61.6 GW and the amount of electricity generated was 79.1 billion kWh, increasing the share of PV solar power energy among the total power sources from 0.4% in 2011 to 7.9% in 2020.

In its 6th Strategic Energy Plan published in October 2021, the Japanese government has fixed a target of 36 to 38% of sharing of the power sources in 2030 and the study group on the proper introduction and management of renewable energy generation facilities of the Agency for Natural Resources and Energy attached to the METI provides, in its report of 26 April 2022, a target for the PV solar power energy of 14 to 16% of sharing of the power sources in 2030 with an installed capacity of 104-118 GW and 129-146 billion kWh of electricity generated.

The war between Russia and Ukraine, which began in February 2022, has led to a sharp rise in the prices of resources such as crude oil and natural gas. As a result, electricity prices in Japan continue to soar. Electricity prices include a fuel cost adjustment item relating to fuel prices. If the procurement cost of fuel rises, the fuel cost adjustment rises accordingly, and the burden increases even if the same amount of electricity is used.

The PV solar power plant can reduce the burden of the electricity bills of the end users, especially in case the PV solar panels are installed in their own houses. In the 6th Strategic Energy Plan published in October 2021, the plan provides that based on the results of the study group on energy efficiency and conservation measures for homes and buildings towards a decarbonized society, the aim is that, by 2050, it will be common to have photovoltaic power generation equipment installed in homes and buildings and that by 2030, 60% of new detached houses will be equipped with photovoltaic power generation equipment.

This innovative and positive perspective for PV solar energy in Japan has started to be implemented by the Tokyo Metropolitan Government. Tokyo is planning to make the installation of rooftop PV solar panels on new homes and building mandatory from April 2025 as it entices Tokyo citizens and energy businesses to shift to renewable energy.

2. The outlook on the renewable energy plans of the Tokyo Metropolitan Government

In accordance with the Japanese government’s target to become carbon neutral by 2050, the Tokyo Metropolitan Government has taken the lead to increase the use of PV solar power energy in its city. The ambitious plan to equip the rooftops with new houses and buildings in Tokyo as announced by the Tokyo Governor, Yuriko Koike in September 2021, was greenlighted by the Tokyo Metropolitan Assembly by way of adoption of an ordinance on 15 December 2022. The ordinance will come into force in April 2025.

Under the new framework, the obligation to install PV solar panels for large structures, such as offices or apartment buildings, falls on anyone who commissions their construction. For other smaller structures with a total floor space under 2,000 square meters, such as detached houses, developers or housing providers are required to install PV solar panels provided that they construct or sell at least 20,000 square meters of total floor space per year in Tokyo, and such obligation will therefore bind 50 major home developers and housing companies in Japan. However, the ordinance exempts houses with roof space of less than 20 square meters as it would be difficult to secure a space for installing the panels, as well as houses facing the north side due to lack of sun exposure. In total, amongst the 50,000 buildings and houses that are built in Tokyo each year, around 20,800 will be concerned by the new rules.

The ordinance does not apply directly to the consumers who purchase homes but they will somehow have to cooperate in a manner to be later clarified by the Tokyo Metropolitan Government. Additional ordinances will set a mandatory tailor-made installation quota target for each concerned company. Indeed, each relevant developer or housing provider will need to report annually to the Tokyo Metropolitan Government the status of its power generation capacity (number of buildings in which renewable energy facilities can be installed x calculation standard rate x standard amount of 2kw per building), the latter which will give birth to a specific target quota of panel installation for each company.

Such quota will be adjusted to the location of the buildings as the Tokyo Metropolitan Government sets 3 different district panel coverage rates depending on the availability of the sun: 30% of panel coverage for Chiyoda and Chuo wards, 85% for Meguro, Setagaya wards and Tama region, and 70% for Musashino ward and the area covering the rest of Tokyo’s 23 wards.

Finally, each developer or housing provider will keep a relative margin as it will be free to choose which properties it will equip with solar panels, as long as it meets its assigned target.

The ordinance does not provide penalties for failing to reach the requirement. However, Tokyo could issue administrative guidance and recommendations to non-compliant companies and publicize their names in case of repetitive non-compliance. On the other hand, monetary incentives will be awarded to exemplary businesses.

The ordinance will entail an initial burden amounting to JPY 980,000 per new house or building constructed. To alleviate such costs, Tokyo will provide JPY 30.1 billion in the form of direct subsidies (meaning that JPY 400,000 of the JPY 980,000 will be covered) destined to companies that construct and sell houses and building in compliance with the new system as well as to some buyers.

Such direct subsidies are part of a total JPY 116.2 billion subsidies package which will be used to help leasing firms reduce lease fees and will also be used to provide other aids to cover some maintenance and inspection costs, the lease of solar panels and roofs, as well as the recycling of these panels which are expected to have an estimated lifespan of 20 to 30 years.

By implementing such plan, Tokyo aligns its renewable energy strategy with some governments in Europe, California, and other states in the U.S. which have already adopted such a framework. And depending on the success of the measure, Tokyo would be able to inspire other Japanese prefectures as a pioneer.

3. The upcoming new reform in the energy regulations in Japan

The Act on the Rational Use of Energy (Act No. 49 of 1979 – the “Energy Act”) has been enacted in 1979 and constitutes the pillar of Japanese energy conservation policy as well as one of the key climate laws in Japan. The Energy Act has been adopted in light of the oil shock which Japan faced in the 1970s to promote the effective and rational use of energy. The Energy Act covers energy management for factories, workplaces, and transportation that consume more than 1,500kL of oil-equivalent energy annually.

Energy defined under the Energy Act covers energies derived from oil, natural gas, coals, heat (fossil-derived), and other sources of energy derived from these elements. Therefore, electricity derived from renewable energy source such as PV solar, wind, and biomass was not subject to the Energy Act.

Since its enactment in 1979, the Energy Act has undergone several major reforms up to the present date according to the social, economic, and environmental requirements. The last reform of 2018 will enter into force from 1 April 2023 (the “New Energy Act”) in order to achieve the carbon neutral target by 2050 and promote the rationalization of the use of energy as a whole, including non-fossil energy, and the expansion of the introduction of non-fossil energy. The New Energy Act will reform the following items.

3.1. Definition of the Energy under the former Energy Act

The former Energy Act defines fossil fuels and fossil fuel-derived heat and electricity as “energy” and requires their rational use. However, non-fossil energy such as electricity and heat from renewable energy sources such as solar power did not fall under the definition of “energy”. On the other hand, the expansion of non-fossil energy on the supply side has been progressing in recent years, such as the expansion of renewable energy.

The New Energy Act revises this definition and makes all energy, including non-fossil energy and renewable energy, subject to rationalization. Non-fossil energy includes biomass, hydrogen, ammonia, waste wood, and waste plastic. This means that from 1 April 2023, energy-saving and other initiatives will be required while using all types of energy as well and the relevant companies must follow the requirement of the New Energy Act such as implementing the rationalization measures related to their activities, the appointment of the Energy management supervisors and energy management planning promoters, the obligation to submit to the METI a monitoring report, etc.

3.2. Conversion to the use of non-fossil and renewable energy sources

The former Energy Act excluded non-fossil energy from the energy used and therefore did not allow for a positive assessment to encourage Japanese companies to switch to non-fossil energy. In order to achieve carbon neutrality, it was necessary to promote the conversion to non-fossil energy not only through the voluntary efforts of some private companies but also the industry as a whole.

The New Energy Act establishes a new system requiring the relevant companies to prepare medium and long-term plans for conversion to non-fossil and renewable energy and to submit regular reports to the METI on the use of non-fossil and renewable energy.

3.3. Changes in electricity supply and demand

One of the objectives of the former Energy Act was to equalize electricity demand (i.e. to reduce seasonal or time-of-day fluctuations in electricity demand) and to require the conversion of electricity used to fuel or heat used during summer and winter and the use of electricity-consuming equipment outside of these periods. However, the recent expansion of variable renewable energy sources such as PV solar power energy has led to the implementation of output control of generated renewable energy electricity in some regions in Japan, and tight supply and demand of electricity due to severe winters and other climatic conditions has become a problem.

Under the new Energy Act, a framework will be established to optimize demand according to the supply-demand situation for electricity, for example by shifting demand during times when there is a surplus of renewable energy and curbing demand when supply-demand is tight. A mechanism is also planned to be established to encourage electricity suppliers to develop tariff systems that contribute to optimizing electricity demand.

LEGAL INSIGHTS IN ASIA

Hong Kong lures family offices with tax incentives

As part of a larger strategy aimed at raising its appeal to wealth management services, Hong Kong has introduced a zero profits tax rate for ultra rich families that set up eligible family-owned investment holding vehicles (“Holding Vehicles”) managed by single family offices (“Family Offices”). The benefits under the recently adopted Inland Revenue (Amendment) (Tax Concessions for Family-owned Investment Holding Vehicles) Ordinance 2023 (the “Amendment”) are offered with retroactive effect from 1 April 2022.

Whereas funds in Hong Kong already benefit from exemptions from profits tax on certain transactions provided specified conditions are met, the Amendment extends this zero-tax regime to qualifying transactions and incidental transactions of Holding Vehicles.

Holding Vehicles

The Holding Vehicle must meet the following conditions to be eligible for the tax exemption in a given fiscal year:

- Organisation. The Holding Vehicle may be any kind of entity such as a body of persons (corporate or unincorporate) or a legal arrangement (including a corporation, partnership and trust) established in or outside Hong Kong as long as it does not have a commercial or industrial purpose and does not carry on any trade or business.

- Ownership. During the relevant fiscal year, at least 95% of the beneficial interest in the Holding Vehicle must be held by one or more members of a single family (family members). If a charitable entity owns a stake in a Holding Vehicle, the threshold for family member ownership is lowered to 75%. The following persons are considered family members: a natural person and such person’s spouse, their lineal ancestors, the siblings of all the aforementioned persons, such siblings’ spouses and their lineal ancestors, and the lineal descendants of the natural person and the aforementioned siblings.

- Management and control. The Holding Vehicle must be normally managed or controlled in Hong Kong. This requirement offers the flexibility for those who control the Holding Vehicle to reside abroad while the management is handled by professionals based in Hong Kong.

- Economic substance. The Holding Vehicle must show a substantial economic presence in Hong Kong. This requirement is satisfied if, during the financial year, it has in Hong Kong (i) at least two full-time qualified employees who conduct its investment activities and (ii) operating expenditures of a least HKD 2 million. Investment activities include conducting research and advising on potential investments by the Holding Vehicle, acquiring, holding, managing or disposing of property for the Holding Vehicle and establishing or administering a special purpose entity for holding and administering investments of the Holding Vehicle.

Eligible Family Office

The Holding Vehicle must be managed by an eligible Family Office. A Family Office must be a private company incorporated in or outside Hong Kong which is normally managed or controlled in Hong Kong. In addition, at least 95% of the beneficial interest in the Family Office must be held (directly or indirectly) by family members. This threshold is lowered to 75% in case a charitable entity holds a beneficial interest. Further, a Family Office must provide services to specified persons of the family (“Specified Persons”) during the relevant fiscal year and the fees for such services must be subject to tax. Finally, a Family Office must comply with the safe harbour rule which requires that not less than 75% of the Family Office’s assessable profits derive from services provided to Specified Persons.

In this context the term ‘Specified Person’ refers to:

- a Holding Vehicle that is related to the family;

- a special purpose entity (“SPE”) in which the Holding Vehicle has a (direct or indirect) beneficial interest;

- an interposed SPE of the Holding Vehicle; and

- a family member.

A single Family Office may not manage more than 50 Holding Vehicles.

Minimum Asset Threshold

In order to qualify for the tax exemption, the aggregate value of assets managed by a Family Office for one or more Holding Vehicles of a family must be at least HK$240 million. The asset threshold is assessed on the basis of the net asset value (“NAV”) of the assets of all relevant Holding Vehicles (including their SPE’s) managed by the Family Office at the end of the relevant fiscal year (“Aggregate NAV”).

Even if the Aggregate NAV for a fiscal year falls short of the required HK$240 million threshold, the threshold will still be deemed to have been met if the Aggregate NAV is not less than HK$240 million at the end of one of the two fiscal years immediately preceding the subject fiscal year.

Tax-exempted transactions

To be eligible for the tax exemption, profits need to be generated by the Holding Vehicle or the SPE from qualifying and incidental transactions carried out in Hong Kong by or through the Family Office or arranged in Hong Kong by the Family Office.

Qualifying transactions are transactions involving shares, stocks, debentures, loan stocks, funds, bonds or notes of, or issued by, a private company, futures contracts, specified foreign exchange contracts, certain deposits, certificates of deposit and exchange-traded commodities. Incidental transactions are transactions, which are incidental to qualifying transactions.

Whereas profits from qualifying transactions are wholly tax exempt, profits from incidental transactions are only tax exempt up to an amount equal to 5% of the total profits generated by both qualifying and incidental transactions.

Conclusion

With the enactment of the Amendment, Hong Kong is signalling to wealthy families that it is an attractive investment destination in East Asia. Family-owned or operated investment vehicles seeking to improve their return on investment should study the opportunities offered by the new rules.

Hong Kong court clarifies that cryptocurrencies are property which can be held on trust

The nature and status of cryptocurrencies under Hong Kong law were recently clarified in the case of Re Gatecoin Limited [2023] HKCFI 914. The High Court of Hong Kong held that cryptocurrencies are property and are capable of being held on trust.

Re Gatecoin Limited: background

Gatecoin Limited (“Gatecoin”) was a Hong Kong incorporated company which operated a cryptocurrency exchange platform. Users of the platform owned “wallets” in which the cryptocurrency was held. Each wallet had a unique address and was associated with two distinct keys: a “public key” (akin to a bank account number) and a “private key” (akin to the user’s PIN code). Users would use their private key to transfer cryptocurrency from their wallets to the wallet of other users.

Gatecoin went into liquidation in 2019. The appointed liquidators of Gatecoin were able to recover cryptocurrencies worth about HK$140 million. The key question to which the liquidators needed an answer was whether these cryptocurrencies were held on trust by Gatecoin for its users. If the answer was yes, the liquidators would need to distribute the cryptocurrencies back to the users as the cryptocurrencies would not be part of the assets of Gatecoin. If the answer was no, the cryptocurrencies would be available for distribution to all creditors, including the users, based on their ranking as creditors and the users would then only have a contractual right to recover their portion of the cryptocurrencies. The liquidators applied to the High Court for directions regarding this question.

Elements of property

In order to respond to the question, the High Court first had to consider whether cryptocurrencies can be regarded as property. The High Court judge applied the test for determining whether a right or interest is a property as laid down in the English case of National Provincial Bank v Ainsworth [1965] AC 1175. The test considers four elements, namely whether the right or interest (i) is definable, (ii) is identifiable by third parties, (iii) is capable of assumption by third parties and (iv) has some degree of permanence and stability. The High Court found that the most detailed application of the property test to cryptocurrencies was the New Zealand case of Ruscoe v Cryptopia [2020] NZHC 728. The New Zealand court determined in that case that cryptocurrencies possess all the above-mentioned elements because they (i) are definable, since each wallet is allocated a public key which is distinct from the keys of other wallets; (ii) are identifiable by third parties, as only the holder of a private key can access and transfer cryptocurrencies from a wallet; (iii) are capable of assumption by third parties, since they can be the subject of trading activities and (iv) have some degree of permanence, as the blockchain stores the entire life history of a cryptocurrency.

Satisfied that the analysis in Ruscoe should be applied to Gatecoin, the High Court concluded that the cryptocurrencies on Gatecoin’s platform constitute property and that it was, in principle, possible to create a trust over such property.

Trust

The High Court then considered whether a trust had been established in favour of Gatecoin’s platform users. In other words, was Gatecoin holding the cryptocurrencies on behalf of the users who were the actual owners or did the users only have a contractual right to the use of the cryptocurrencies, which were in fact the property of Gatecoin.

The High Court first confirmed that the creation of an express trust requires the presence of the so-called three certainties: (i) certainty of subject matter; (ii) certainty of object (i.e. beneficiaries) and (iii) certainty as to the intention to form a trust. The High Court found that the first criterion was satisfied in the Gatecoin case because each user’s cryptocurrencies, even if not segregated from those of other users, were capable of being identified by reference to their proportionate share vis-à-vis the entirety of the cryptocurrencies available on the Gatecoin platform. The second criterion was also met because each user could be identified on Gatecoin’s internal exchange ledger.

As to the third certainty – the intention to form a trust – the High Court reviewed the three sets of Terms and Conditions (“T&C”) that Gatecoin had used for its platform over the years. The High Court held that the most recent T&C (“2018 T&C”) had superseded the earlier T&C for those users who had clicked the “accept” button with respect to the 2018 T&C. This included all users who had logged onto the Gatecoin platform after the introduction of the 2018 T&C as acceptance of the 2018 T&C was a condition for continued access to the platform. The High Court found that, under the 2018 T&C, Gatecoin had expressly disclaimed all fiduciary duties and therefore did not intend to hold the cryptocurrencies on trust for the users. At the same time, the High Court recognized that a trust had been created in favour of users who had not accepted the 2018 T&C (and therefore had not accessed the Gatecoin platform after the introduction of the 2018 T&C) as the older T&Cs, which continued to apply to these users, did contain express trust language.

Takeaways

The recognition that cryptocurrency constitutes property affords significant protection to cryptocurrency holders in Hong Kong as they will be able to enjoy the usual rights available to owners of property as recognised under Hong Kong law. Re Gatecoin Limited further provides useful guidance on the elements which determine whether a trust over cryptocurrencies has been created. Users and platform operators should make sure that the terms and conditions of use of a cryptocurrency trading platform correctly reflect the nature of the interests and relationship they wish to create to better safeguard their interests.

Camilla Venanzi | Erik Leyssens

France takes the lead as the key jurisdiction for foreign investments in Europe

Europe is the third-largest economy in the world (after the US and China), and France is one of the largest economies in Europe, with developed infrastructures, a central geographical position, and a stable political system. As such, France is one of the most popular destinations for foreign direct investments (FDI) in Europe, with a variety of targets, ranging from luxury goods to high-tech companies.

The 2023 study from EY reviewing the attractiveness of European countries confirmed that status for 2022. France ranked first in terms of number of FDI in Europe, including R&D centres projects, well above its traditional competitors, the UK and Germany.

Following the election in 2017 of a new, business-friendly president, Emmanuel Macron, a series of reforms have been implemented to make France more attractive to foreign investors. For instance, the government of President Macron has decided to lower the French corporate income tax rate gradually to 25% (from more than 33.3% in 2017), to develop tax incentives for innovation. Major changes have also been decided to make French labour law more flexible, with a simplification of the employees’ representation system and clear rules for dismissing employees (reducing the severance cost and the risks of litigation).

The re-election of Emmanuel Macron in April 2022 for a second term of five years sent a strong signal to economic players and foreign investors that France will develop an even more business-friendly environment and will strengthen its efforts to attract foreign investments. The challenge is for France to address post-COVID issues successfully and ensure that its economy and finances can cope with increased uncertainties (war in Ukraine, inflation, etc.).

Chinese investments in France: key figures

Despite the impact of the COVID-19 crisis, which stalled a number of projects, China remained the leading Asian investor in France in 2022. Chinese investment in France targets all kinds of sectors and types of businesses, from family businesses to listed groups (for example, Lanvin, Accor Hotels), in industries as diverse as tourism (Club Med), fashion brands (Baccarat), food and wine, football clubs, electrical equipment, and the automotive sector (car parts manufacturer Le Bélier).

However, as the world recovered from the pandemic, and particularly in 2022, Chinese investments refocused on strategic sectors such as technology and infrastructure.

To date, there are over 900 subsidiaries of Chinese businesses established in France, in which more than 50,000 people are employed. A large diaspora of Chinese companies and Chinese executives are settled for good in France and contribute to the development of a vibrant Chinese business community in France.

The outlook for Chinese investment in France remains promising. Indeed, despite the effects of the COVID-19 crisis, foreign businesses established in France are not considering curbing activities in France, and although certain projects have been postponed, many opportunities can be seized.

Much restructuring and M&A activity is expected with the increase in interest rates, as a lot of French companies will want to refocus on core business and divest other activities, and many other companies will be looking for new investors to bring much-needed financing.

France is also benefiting from Brexit, as the UK was previously one of the preferred investment destinations in the EU, and from China’s rising trade tensions with the US, which traditionally absorbed one of the largest chunks of Chinese FDI.

These circumstances, combined with the positive effects of President Macron’s reforms, make France a desirable entry point for Chinese investors looking to develop operations in Europe.

French foreign investment controls

In principle, foreign investment in France is free and not subject to governmental approval. However, in certain industries which are deemed sensitive or related to national defence, a prior authorisation from the French government may be required.

French law (Section L.151-3 of the French Monetary and Financial Code) traditionally provides that certain foreign investments in activities relating to national security or critical for public safety are subject to prior approval by the French Ministry of the Economy.

The French government has been extending the list of industries deemed ‘sensitive’ to the French economy and subject to prior approval. The list now includes investments in telecoms, transportation and public health (with the addition of biotechnologies, as a result of the COVID-19 crisis), technologies with a dual use (civil and military), and certain IT and telecoms areas (robotics and artificial intelligence, cryptology, communications and transportation networks and services).

The requirement for prior approval applies to investments made:

- By investors registered in the EU or the European Economic Area (EEA), when they take control of a company active in these industries; and

- By investors from other jurisdictions (outside the EU/EEA), when they acquire more than 25% of the share capital and voting rights of a company active in such sensitive industries.

Established as a temporary response to the COVID-19 crisis, the French government has also extended its control to investments in listed companies (for those active in these industries) when they exceed 10% of the voting rights. This measure will apply until December 31 2023.

The authorisation process is quite straightforward: the request is submitted to the Ministry of the Economy, which has 30 days to review the investment and approve it or request additional information (in which case, its review must be completed within 45 days of the application). In practice, longer review periods, such as three or four months, should be anticipated if the Ministry of the Economy requests supplemental information and/or considers imposing conditions to clear the case (which was the case for half the FDI filings made).

However, Regulation (EU) 2019/452, which came into force at the end of 2020, adds a new layer of foreign investment control. Under this regulation, in the course of its review, the French Ministry of the Economy must notify the foreign investment project to the European Commission, and other member states may request that conditions be added where the foreign investment could also have an impact in their jurisdiction on their own public safety or public order.

There are no foreign currency or foreign exchange restrictions in France.

Antitrust

In terms of competition policy, the French authority that oversees competition clearance is the French Competition Authority (Autorité de la Concurrence), an independent administrative agency.

French merger control applies if the turnovers of the parties to a transaction (the acquirer, the target and their subsidiaries) exceeded, in the last financial year, certain (cumulative) thresholds provided in Article L. 430-2, I of the French Commercial Code. The thresholds include a worldwide turnover by all parties exceeding €150 million (approximately $163 million) or a turnover in France exceeding €50 million for at least two of the parties. Transactions are not subject to notification in France if they are notified at the EU level.

Under Article L. 430-3 of the French Commercial Code, a notifiable merger cannot be finalised before it is cleared by the French Competition Authority. There is no filing fee. Failure to notify a reportable transaction is subject to daily penalties and fines.

The majority of notified transactions are cleared within 25 business days of their notification filing. However, certain transactions go through a more in-depth Phase II review, which requires an additional 65 business days.

In terms of investment techniques, French corporate law offers various forms of corporate vehicles that can be used for an acquisition or a joint venture, including the equivalent of a limited liability company and a company limited by shares.

One of the most commonly used legal entities used by Chinese investors for large transactions is the simplified joint stock company (société par actions simplifiée, or SAS), as it is a very flexible corporate form: it can be established with a single shareholder and with limited share capital, and the rules governing its functioning are very flexible and can be organised to a large extent freely in the by-laws.

In general, there are no requirements that impact a Chinese investor particularly. French law does not require the participation of a French citizen or entity in French commercial companies, either as shareholders or as directors or officers. Recent regulations requiring the disclosure of the ultimate beneficial owner of a French company, however, do sometimes raise disclosure issues with Chinese investors.

Dispute resolution

On November 28 2007, France and the People’s Republic of China signed a bilateral investment treaty which came into force in France in 2011. It is worth highlighting that French courts are independent and commercial matters are judged in courts composed of professional judges, with an appeal process in front of professional judges. There are also various summary proceedings that can allow an investor to enforce its rights efficiently.

French courts also duly deliver the exequatur allowing foreign judgments and international arbitration awards and deeds received by foreign officers when such judgments and awards have complied with basic principles designed to ensure the fairness of the trial and rights of the defendant.

Furthermore, France is party to multiple European and international conventions, as well as bilateral treaties (including with China), that provide simplified legal frameworks for the recognition and the enforcement of foreign judgments and judicial cooperation. French judgments and arbitration awards rendered in France (for instance, under the International Chamber of Commerce Arbitration Rules) are generally enforceable in other jurisdictions.

Tax

Traditionally, Chinese investors would establish holding companies in Luxembourg to benefit from lower corporate income tax (CIT) rates. However, these structures are coming under scrutiny from French tax authorities and there is an increasingly common requirement to have ‘substance’ in Luxembourg (for instance, actual staff and operations), which is quite costly and burdensome to meet.

Now, the CIT rates in France and in Luxembourg are nearly similar; therefore, this type of tax structuring via Luxembourg is no longer useful.

Indeed, since January 1 2022, a 25% CIT rate applies to all companies, regardless of turnover.

Small companies (for example, enterprises at least 75% owned by individuals or by other small enterprises and with a turnover of €10 million or less) are taxed at a reduced rate of 15% on the first €38,120 of profits and at the standard CIT rate on any excess (Article 219-I-b of the French Tax Code).

Gross dividends distributed to corporate shareholders outside France are subject to a final withholding tax of 25%, unless there is a tax treaty between France and the foreign country that provides for reduced withholding tax rates (as described below, China and France have signed a treaty providing for a favourable tax treatment). However, no withholding tax is levied on dividends paid by a French company to a qualifying parent company resident in the EEA if certain conditions are met.

Foreign companies established in France enjoy the same government aid and incentives as French companies (support for productive investment, R&D, professional training and job creation, among other activities). France also offers tax and non-tax incentives to French and foreign businesses that are:

- Creating new, or expanding existing, businesses in certain French regions;

- Acquiring declining industries; or

- Decentralising their activities out of the Paris and Lyon regions.

In addition, taxpayers in France (including foreign investors who have established a business in France) may benefit from the attractive R&D tax credit system. The R&D credit, which takes into account the annual volume of expenditure, amounts to 30% of the expenses related to R&D operations up to a value of €100 million, and 5% for anything above that. Higher rates apply to companies that have never benefited from the credit and those that did not benefit from the credit for a five-year period. Certain conditions must be met.

France and China signed a revised double taxation agreement (DTA) on November 26 2013. This agreement reduces the withholding tax rates applicable to dividends, royalties and interests. A Chinese investor will be taxed only 5% on the repatriation of dividends from France if the investor holds 25% of the shares or voting rights in the French company (the withholding tax rate will be 10% in all other cases). Withholding taxes on royalties and interests paid to investors resident in China are also reduced to 10%.

The DTA also helps to eliminate any double taxation arising from cross-border transactions and to secure the tax position of Chinese investors.

This article was published in IFLR’s Chinese Outbound Investment Guide 2023.

Raphaël Chantelot | Ran Hu | Hubert Bazin | Fanny Nguyen | Nicolas Vanderchmitt

Highlights on amendments of the counterespionage law and compliance measure

On April 26th, 2023, the newly amended Counterespionage Law of the People’s Republic of China (the “New Counterespionage Law”) was promulgated and will come into force on July 1st, 2023. Compared to the Counterespionage Law promulgated in 2014, the amendments to the new Counterespionage Law expand the scope of espionage activities, enhance the authority of administrative enforcement, and specify the legal liability for espionage activities. These revisions reflect China’s proactive approach to combating espionage and regulating related industries to ensure national security and interests.

Expansion of Espionage Activities and Application Scope

The New Counterespionage Law defines espionage in a detailed and comprehensive manner. The essential elements of espionage activities include the involvement of an “espionage organization and its agents” and activities that endanger national security and interests.

The New Counterespionage Law broadens the definition of espionage activities by including the following acts within its scope:

- Joining an espionage organization and its agents;

- Activities involving the theft, spying, purchase, or illegal provision of documents, data, materials, or articles related to national security and interests;

- Activities such as cyberattacks, intrusions, interference, control, or destruction, among others, carried out against a state organ, secret-involved entity, critical information infrastructure, etc., by an espionage organization or its agent, or by any other person instigated or funded by the aforementioned organization or individual, or by any domestic institution, organization, or individual colluding with the aforementioned organization or individual.

Foreign-invested enterprises operating in China should pay particular attention to the activities described under point c) above, as some of these enterprises may be critical information infrastructure operators (“CIIOs”) themselves or may possess information related to the network security of CIIOs due to their business relationships. In such cases, if information on network security vulnerabilities is provided to foreign parties without proper scrutiny, there is a potential risk of constituting espionage. Moreover, the scope of objects (i.e., documents, data, materials, or articles relating to national security and interests) mentioned in point b) is also broad, which means that non-public information in sensitive areas such as military, national defense, or science and technology (disclosed during a due diligence process, for instance) may be subject to protection under the New Counterespionage Law.

Additionally, espionage activities carried out by espionage organizations and their agents against a third state in China, endangering China’s national security, also fall within the scope of application of the New Counterespionage Law.

Granting National Security Authorities Additional Enforcement Powers

The New Counterespionage Law empowers national security authorities with additional investigation powers, including checking identification, questioning individuals, inspecting belongings, examining relevant equipment and tools, summoning individuals, and accessing and retrieving relevant data and information.

Moreover, the national security authorities have the authority to seal, seize, or freeze premises, facilities, or property, as well as to restrict entry and exit in certain cases. Technical reconnaissance measures may be applied upon obtaining the necessary approvals.

Notably, if the national security authorities discover cybersecurity risks related to espionage activities, they are required to notify the Chinese Cyberspace Administration, which can take measures such as requesting operators to address vulnerabilities, stopping transmission, and shutting down relevant websites.

Legal Liability Refinement

The New Counterespionage Law provides more detailed provisions on administrative penalties. Specifically, it establishes a “double punishment system” for legal entities engaged in espionage activities, whereby the direct person-in-charge and other individuals directly responsible for such legal entities may receive a warning or administrative detention depending on the specific circumstances. Furthermore, if an act of espionage under the New Counterespionage Law constitutes a crime, the relevant enterprises and individuals will face criminal liability.

Compliance Measures for Foreign-Invested Enterprises

Considering the New Counterespionage Law, it is crucial for foreign-invested enterprises to reassess their compliance level to avoid any liability. Here are some recommendations to keep in mind when conducting business in China:

- Conduct background checks in business transactions: It is important to perform necessary background checks on counterparties, especially overseas customers. Foreign-invested enterprises should request counterparties to provide relevant information or issue undertaking letters to confirm that they do not belong to espionage organizations or act as agents of espionage organizations. Additionally, assessing the reputation and background of potential partners, suppliers, and customers can help minimize the risk of unauthorized access to sensitive information.

- Strengthen internal data compliance management and secure information systems: Companies should review their internal data assets to identify documents and data that may qualify as national secrets or important data related to national security and social interests. It is important to note that there is no clear definition of “national security.” Implementing a data classification system to differentiate sensitive and non-sensitive information and granting access to sensitive information to limited and necessary employees is advisable. Conducting background checks and periodic reviews of personnel in key positions, such as departments responsible for providing data to the public, should also be carried out.

Implement robust cybersecurity measures: Foreign-invested companies should establish strong cybersecurity measures to protect their data and information systems from potential cyber threats. This can include secure networks, encryption, firewalls, and regular security audits. - Conduct internal compliance activities for counterespionage risks: It is necessary to provide comprehensive training to employees regarding the New Counterespionage Law and other relevant regulations. Ensure that employees understand their responsibilities and obligations in handling sensitive information.

Nevertheless, companies should remain vigilant and monitor business operations for any signs of suspicious activities that may indicate potential espionage or unauthorized disclosure of sensitive information.

Please note that the suggestions provided above are general in nature and may not cover all specific risks or circumstances. Feel free to contact us for further information.

Proposed changes to companies act on digital meetings and minority protection

On 6 February 2023, the Ministry of Finance (“MOF”) and the Accounting and Corporate Regulatory Authority (“ACRA”) issued their responses to key feedback received on proposed amendments to the Companies Act 1967 (“CA”) with respect to:

- facilitating digital general meetings and digital board meetings;

- clarifying the application of existing digitalisation provisions to documents under the CA;

- other areas concerning digitalisation; and

- review of the threshold for the compulsory acquisition of shares under section 215 of the CA.

Facilitating digital general meetings and digital board meetings

The current version of the CA does not contemplate the ability of companies to conduct general meetings via electronic means. During the pandemic, companies were able to rely on the temporary measures due to COVID-19 to held general meetings despite lock-down. The proposed amendments to the CA below formalise companies’ ability to conduct general meetings through electronic means.

MOF/ACRA have accepted to include provisions permitting companies to hold general meetings digitally and in more than one location, and to amend certain specific provisions in the CA to address any ambiguity as to how shareholders’ rights may apply to digital meetings. Such proposals specify that companies that hold digital general meetings must use technology that enables members to attend, listen, speak and vote at the meeting, and to specify that companies may hold digital general meetings unless expressly prohibited by their constitution.

Additional safeguards and requirements may be introduced subsequently via subsidiary legislation, which is likely to be inspired by or adapted from current how-to guidance for system service providers that enable the holding of digital general meetings.

Clarifying and refining the application of existing provisions on electronic transmission of documents and communications

As a corollary to the ability to conduct general meetings via electronic means, the amendments in this section also seek to formalise companies’ ability to send and receive documents from various parties in electronic form, now all documents that the CA requires or permits companies or directors to send to members, officers or auditors could be sent in electronic form. Companies would be required to accept proxy instructions given by electronic means.

Clarification would be provided on the operation of provisions allowing the electronic transmission of notices and documents to members, officers or auditors. The same will be done for the electronic safekeeping and storage of documentation, including for the purposes of inspection..

Review of the threshold for the compulsory acquisition of shares under section 215

Under the existing Section 215 of the Companies Act, the right for a person (an “offeror”) to compulsorily acquire all the shares of a company (including those held by dissenting shareholders in a scheme or contract involving the transfer of those shares) is subject to the offeror having achieved a 90% acceptance threshold for the relevant scheme or contract, with certain exclusions (notably shares held by a nominee or a related corporation of the offeror are excluded from computing the 90% acceptance threshold).

The exclusions are now proposed to be expanded, and would exclude shareholdings held by close relatives, corporate entities controlled by the offeror, the ultimate controller, as well as individuals or corporate entities controlled by the ultimate controller.

MOF/ACRA have accepted the proposal with modification and following the public’s feedback, will modify the threshold to establish control of a body corporate to 50%, instead of the 30% threshold that was originally proposed. This will be in line with similar concepts in the CA and the Singapore Code on Take-Overs and Mergers.

The next step for this round of legislative changes is the tabling in Parliament, and if successfully passed, the amendments would be brought into force on a date to be notified in the government gazette.

Upcoming changes to Employment Pass eligibility requirements in 2023

In order to enhance Singapore’s workforce quality and diversity, two major changes have been applied to the eligibility requirements for employees currently working or aiming to work in Singapore under an EP. Those changes will come into effect from 1 September 2023.

Overview of changes to EP eligibility

Candidates must pass a two-stage eligibility framework:

- Stage 1: Earn at least the EP qualifying salary, which is benchmarked to the top 1/3 of local professionals, managers, executives and technicians (‘’PMET’’) salaries by age.

- Stage 2: Pass COMPASS.

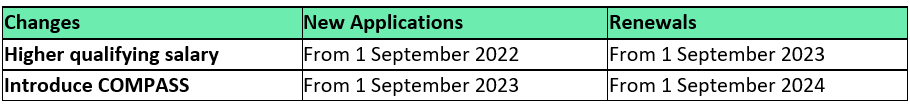

To give employers time to adjust, the MOM has implemented a progressive timeline:

Source: Overview of changes to Employment Pass eligibility (MOM website)

Higher qualifying salary to EP

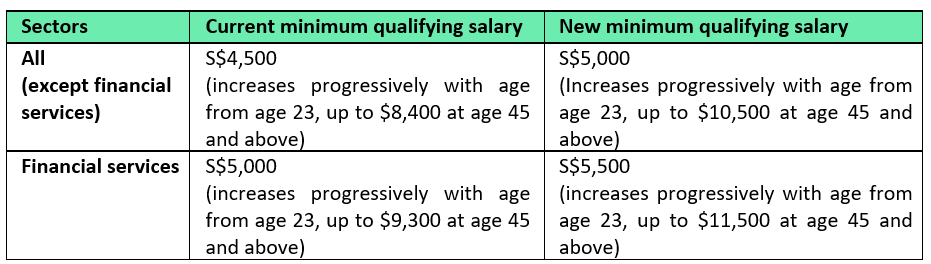

To raise the quality of EP holders and reflect local PMET wage trends, the EP qualifying salary will be benchmarked to salaries of the top one-third of the local PMET workforce. The MOM distinguishes the workers depending on their work sector and their age (as the minimum qualifying salary increases progressively with age).

Source : Eligibility for Employment Pass (MOM website)

Complementary Assessment Framework (COMPASS)

In addition to meeting the qualifying salary (Stage 1), EP candidates must pass a points-based Complementarity Assessment Framework (COMPASS) (Stage 2).

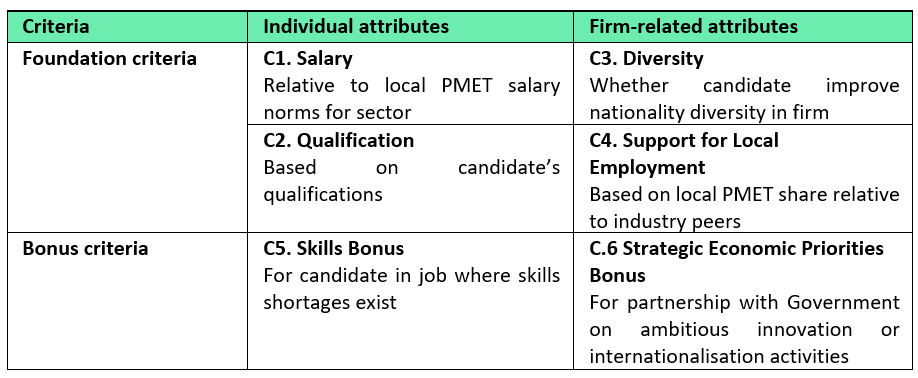

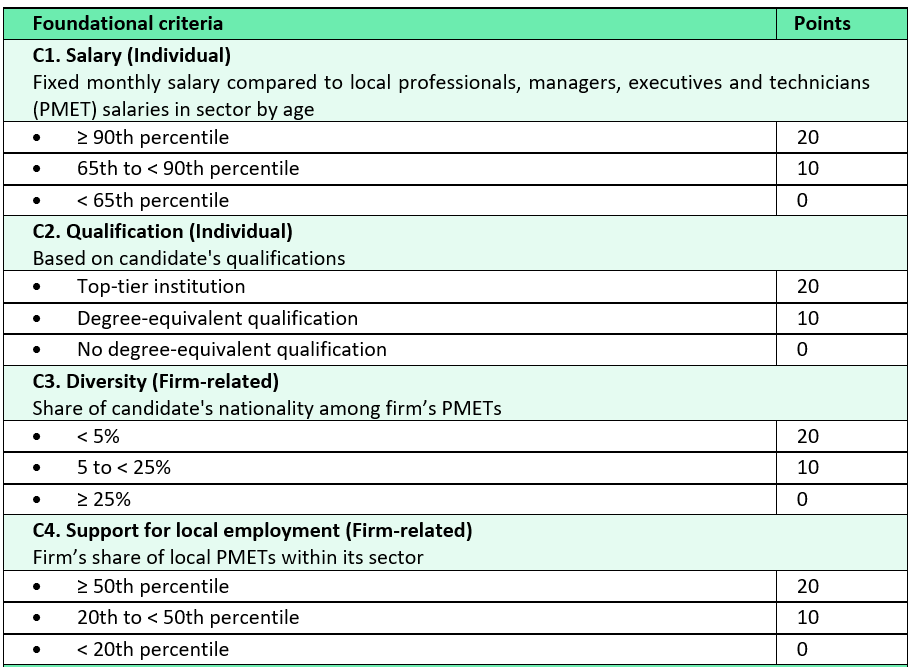

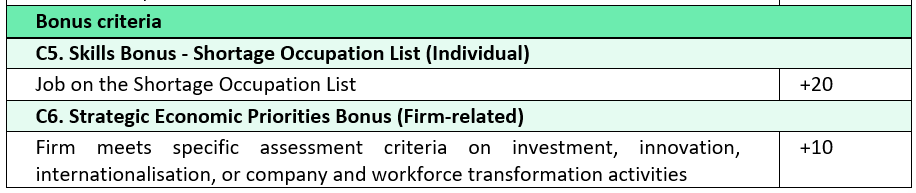

The new system is based on four basic criteria (Salary, Diversity, Qualifications, Support for Local Employment) and two “bonus” criteria (Skills bonus, Strategic Economic Priorities).

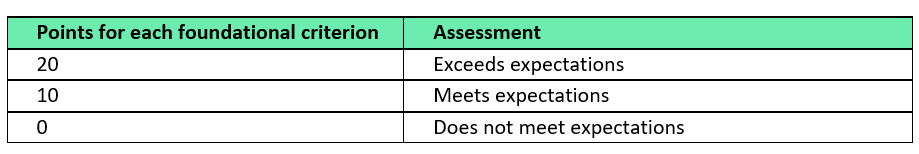

The table below summarises how points are earned:

Source : Complementarity Assessment Framework (COMPASS)

A total of 40 points will be required to obtain the EP. This can be achieved either by earning 10 points on all foundational criteria, making up the required points by exceeding expectations on another criterion or by scoring bonus points.

However, a candidate can be exempted from COMPASS under three hypothesis:

- Earning at least $22,500 fixed monthly salary

- Applying as an overseas intra-corporate transferee under the World Trade Organisation’s General Agreement on Trade in Services or an applicable Free Trade Agreement that Singapore is party to.

- Filling a role on a short-term basis (1 month or less).

Graciane Paitard-Albin | Astrid Cippe

What are the HR obligations applicable to your company?

When hiring new employees, a Japanese company may achieve thresholds as from which specific obligations will apply. The main thresholds are 10 employees, 50 employees and 101 employees. As a principle, only regular employees are counted as “employees” when counting the number of employees of the company (excluding fixed-term employees), but some exceptions may apply depending on regulations. Please be aware that obligations may apply when reaching a certain number of employees in a specific office (e.g. Tokyo Office) or when the company hires a certain number of employees in total.

1 employee: as from 1 employee, the provisions of the Labor Standards Act, the Industrial Safety and Health Act and the Workers’ Accident Compensation Insurance Act apply to employment of such employee. The employer has therefore the obligation to (i) provide the employee with a notice regarding his/her employment condition or conclude an employment agreement, (ii) conclude a 36 agreement with the representative of the employees and submit it to the Labor Office, if overtime work is required from the employee, (iii) organize medical checkup upon hiring and at least once a year thereafter and (iv) subscribe to the labor insurance that includes worker’s accident insurance and unemployment insurance.

5 employees: as from 5 employees hired in total, although some exception applies to specific business fields (e.g. companies in the agricultural, forestry and fishing industries), employers have the obligation to subscribe to the social insurance that includes health insurance and welfare pension. In practice, most companies start subscribing to the social insurance as from their first employee.

10 employees: as from 10 employees per office, companies have the obligation to (i) establish rules of employment and submit them to the Labor Office and to (ii) appoint a Safety and Hygiene Promoter or a Hygiene Promoter and display his/her name in the office.

43 employees: as from 43 employees in total, companies have the obligation to hire at least 1 disabled person representing at least 2.3% of overall employees.

50 employees: as from 50 employees per office, companies have the obligation to (i) appoint industrial doctor (ii) appoint safety manager and health manager and establish safety committee and hygiene committee (iii) submit reports on the results of annual medical checkup to the Labor Office and (iv) conduct stress checks and report the result thereof to the Labor Office.

101 employees: as from 101 employees hired in total, companies have the obligation to (i) establish, submit to the Labor Office and publish general employer action plans regarding work/life balance for employees with child, (ii) publish information on the success of women in their company and (iii) apply the disability allowance schemes (obligation to pay JPY 50,000 per month per missing employees if the rate of 2.3% of disabled employees is not achieved).

301 employees: as from 301 employees hired in total, companies have the obligation to publish information about the hiring rate for people with work experience (employees who have not recently graduated).

501 employees: as from 501 employees hired in total, companies have the obligation to extend social insurance to all part-time employees.

1000 employees: as from 1000 employee hired in total, companies have the obligation to publish information regarding use of childcare leave system by male employees.

What are the new restrictions applicable to consumer agreements?

Consumer Contract Act was amended effective from 1 June 2023, to apply the following new restrictions to consumer agreements concluded between professional and consumers.

New reasons for cancellation of consumer agreements (article 4.3)

In addition to the reasons for cancellation already provided by the Consumer Contract Act, consumer has now the possibility to cancel the agreement for a period of 1 year as from the date it is aware of its cancellation right (or 5 years from the date of conclusion of the agreement) in the following 3 cases:

- the professional invites the consumer to a place difficult to leave without informing the consumer in advance about its intention to solicit him/her;

- the professional uses intimidating language or behavior to obstruct the possibility for the consumer to obtain prior advice; and

- the professional has amended the state of the product before conclusion of the agreement and forces the consumer to conclude the agreement as reinstatement of the product to its initial state is complicated.

Best effort obligation to provide information about cancellation fees (article 9.2)

A best effort obligation has been imposed on professionals to explain the basis for the calculation of the cancellation fee, if requested by the consumer. Concretely speaking, this includes obligation to explain the calculation formula, the reasons for adopting such formula and the reasonableness of such cancellation fee.

Prohibition of vague disclaimer clauses (article 8.3)

Even before its amendment, the Consumer Contract Act considered clauses excluding the liability of the professional in case of willful misconduct or gross negligence to be invalid. However, as lot of professionals had provided in their terms and conditions provisions excluding their liability in an unclear manner, the Consumer Contract Act was amended to make void and null all clauses that are unclear regarding the scope of exclusion of the liability of the professional and that do not state that the exclusion of liability is limited to “minor infringement”.

- Invalid clause example: “Unless otherwise provided by applicable law and regulation, the professional shall indemnify the consumer within the limit of JPY 10,000.”

- Valid clause example: “in case of minor infringements, the professional shall indemnify the consumer within the limit of JPY 10,000.”

Expansion of best effort obligation applicable to professionals

The Consumer Contract Act have increased the scope of best effort obligation applicable to professional regarding the provision of information to consumers and association of consumers as follows:

- When soliciting a consumer to conclude a contract, the professional shall make his/her best efforts to provide the consumer with the necessary information about the contract, taking into account the consumer’s age and mental and physical condition as well as his/her knowledge and experience.

- The professional shall make his/her best efforts to provide consumers with the information necessary to exercise their right of cancellation.

- The professional shall make his/her best efforts to provide consumers with information about their right to have access to the content of standardized terms and conditions.

- The professional shall make his/her best efforts to disclose the content of standardized terms and conditions to consumer associations.

OUR LATEST DEALS

AAA / aerospace industry

LPA Singapore and LPA-CGR avocats (Paris) assisted the shareholders of AAA (Assistance Aéronautique et Aérospatiale), a French key player in the aerospace industry for on-site operations, on the sale of AAA to Daher, an aircraft manufacturer and manufacturing services provider. With the AAA acquisition, Daher becomes the benchmark in manufacturing services for France and takes a leadership position globally. See more (in French)

Altavia Group / retail sector

LPA-CGR (Hong Kong) and LPA-CGR (Shanghai) advised Altavia Group, a leading independent and international marketing communication group in the retail sector, on the acquisition of the Asian agency Sina Retail, a well-established retail design and project management agency with offices in Hong Kong, Shanghai, Guangzhou and Sanya. LinkedIn

FreeD Group

LPA Singapore and LPA-CGR (Hong Kong) recently advised FreeD Group on a financing transaction allowing the group to raise up to USD 15 million from a strategic investor in the context of its pre-series C fundraising round. FreeD group is a Digital and Smart Merchandising Solution company utilizing Artificial Intelligence, Big Data and Machine Learning technologies to provide end-2-end digital solutions.

NEWS FROM LPA

Team | On June 20th, 2023, the General Assembly of partners of LPA-CGR avocats, which includes its 42 partners, renewed the composition of its governing bodies – the Executive Board and the Executive Committee. The General Assembly of partners elected Frédéric Bailly (Mergers & Acquisitions) as Chairman of the Executive Board, and Sandra Fernandes (Real Estate Tax) and Raphaël Chantelot (Mergers & Acquisitions) as Managing Directors, for a 2-year term. The Executive Committee is composed of the 3 members of the Executive Board and 5 other partners: Julie Cittadini (Restructuring), Xavier Clédat (Litigation), Sidonie Fraiche-Dupeyrat (Real Estate), Sophie Marinier (Employment) and Silke Nadolni (Real Estate), also elected for a 2-year term. LinkedIn (in French)

Team | Sabrine Cazorla Reverre joined LPA Singapore in April 2023 as of Counsel to lead and develop the Family and Estate practice. Resident of Singapore for nearly 15 years, she provides advice on family law matters to French expatriates and individuals connected to France. LinkedIn (in French)

Team | Karim Boursali joined the Corporate and M&A Team of LPA Singapore as Associate in March 2023. He advises French and international companies, financial institutions and institutional investors on their public or private mergers and acquisitions, capital markets transactions and strategic partnerships. Prior to joining LPA Singapore, Karim trained and practiced several years in the corporate departments of leading international law firms in France and Germany.

Team | Emma Zheng joined the Corporate and M&A team of LPA Shanghai as Associate in June 2023. She is qualified in Chinese Law and brings significant experience advising foreign companies in their investment projects in China. Emma provides day-to-day legal support in the areas of corporate law, contract law, labor law, intellectual property law and commercial law.

Interview | Ayano Kanezuka, Partner at LPA Tokyo, had the honor of participating in two TV shows on NHK, the Japanese national channel, alongside eminent specialists in religion, to present the French law of 2001 aimed at combating sectarian abuses. LinkedIn

Publication | Ayano Kanezuka,Partner at LPA Tokyo, has co-written a book titled “フランス憲法と社会”(French Constitutional Law and Society) in which she addresses the issue of fundamental freedoms during the pandemic. It includes contributions from several specialized professors of French constitutional law. The book appears to not only introduce the French constitutional system, but also examine how it interacts with society, making it a unique publication. LinkedIn

Publication | On the occasion of the 40th anniversary of the law firm LPA-CGR Avocats in 2023, we had the opportunity to retrace our history and the major milestones that have marked our development, in an article published in the latest issue of Juristes Associés in France. “A shared vision and ongoing commitment.” That’s how our firm, which ranks among the top 10 independent French law firms, defines itself. With an unwavering commitment to openness that characterizes us! LinkedIn (in French)

Upcoming event | LPA Singapore is delighted to announce its participation and sponsorship of the “Welcome” event organized by the French Chamber of Commerce in Singapore (FCCS) on September 20th, 2023. Members of the FCCS, as well as newcomers, are invited to join the French business community for a networking session set in the idyllic and lush surroundings of the Sofitel Sentosa Hotel. This exclusive back-to-school evening promises the presence of esteemed guests, including Her Excellency, the Ambassador of France to Singapore, along with representatives from various French institutions. Members of the Chamber of Commerce board and representatives of major French companies established in Singapore will also be present. See more

Past event | Arnaud Bourrut Lacouture, Managing Partner at LPA Singapore, has been invited by Mazars in Asia Pacific to speak at their webinar “Tax and Legal considerations of M&A in APAC 2023” to discuss about the differences, advantages and pitfalls of an asset deal versus a share deal. LinkedIn

Past event | Sabrine Cazorla Reverre and Wolfram Günther, Counsels at LPA Singapore, co-organized alongside Equance, an asset and wealth Management company, and in partnership with the French Chamber of Commerce in Singapore (FCCS), a conference on the topic of “retirement and succession planning for French expatriates in Singapore” on 24th May 2023. LinkedIn

Past event | As president of the Tax and regulations committee of the CCIFJ, Lionel Vincent, Managing Partner at LPA Tokyo, organized a conference on “Strategic Plan for FDI in Japan – new opportunities for foreign investors in Japan” with Katsuro NAGAI, Director-General of the Office of Foreign Direct Investment Promotion, Cabinet Office as key speaker on 8 June 2023. LinkedIn

Past event | LPA-CGR avocats was delighted to host a roundtable discussion organized by the Hong Kong Trade Development Council and the France Hong Kong Business Association on June 14th 2023. During this event, led by Nicolas Vanderchmitt, Partner and Head of our Hong Kong office, French startups operating in Asia had the opportunity to exchange views on the Hong Kong ecosystem. LinkedIn

Past event | Ayano Kanezuka, Partner at LPA Tokyo and Vice-President of the International Commission of the Tokyo Daini Bar Association, was the guest of honor at the Toulouse Bar Association to participate in a symposium on “access to justice worldwide, in Japan, and the situation in France, particularly in Mayotte” on June 16th 2023.